Average Spend 9. Cloth Diapers She then takes the paperwork to the diaper banks, and if they are approved, she picks up the diapers needed for their childcare days, saving parents precious time and fuel costs and letting families get kids into care faster. Management at both companies followed a similar business model. The introduction of new features, such as wetness indicators and skin-friendly materials has breathed new life into the market. By Age Manufacturers are continually working on improving diaper designs to enhance comfort, fit, and leak protection. Swim diaper segment is anticipated to flourish at a CAGR of 1. Bumkins South Africa Seventh Generation Inc Retailers and e-commerce platforms have been expanding their private label diaper offerings. Supply Side Analysis 5.

With increasing environmental consciousness, the demand for eco-friendly and sustainable diaper options has been on the rise, prompting some consumers to switch to biodegradable or cloth diapers. The Honest Company Inc. Y-o-Y Growth Trend Analysis 6. Gender First, unlike the s, there is no competition in the middle-class of the market to ensure reasonable prices for consumers. Flat Cloth Diaper 6. Subscription services were gaining traction as they provide a hassle-free way for parents to get regular diaper deliveries. Wearable technology has extended to the baby diaper market with the introduction of smart diapers. The Consequences Are Deadly. Incremental Opportunity, by Region 9.

Scale Based Cost Advantage

Raw Material Analysis 5. Today, even families who enjoy greater economic stability understand the fragility of access to basic goods. Kimberly-Clark Corporation Training Diaper Reporting by Emily Stephenson. Smart diapers may connect to mobile apps, enabling parents to track their baby's well-being and detect potential health issues. Baby Diaper 9. In , three days before the trial, the companies decided it was better to collude than to compete. Please Enter Valid Email. United States Product Market Outlook 7. At this time, a handful of pharmaceutical and medical supply manufacturers dominated the industry.

United States Baby Diaper Market demand to | FMI

- Opportunity Analysis 7.

- Regular Diaper

- Modern Trade

- Today, more than diaper banks operate across the U.

- Parents in the group have posted stories about their children's reactions to the diapers.

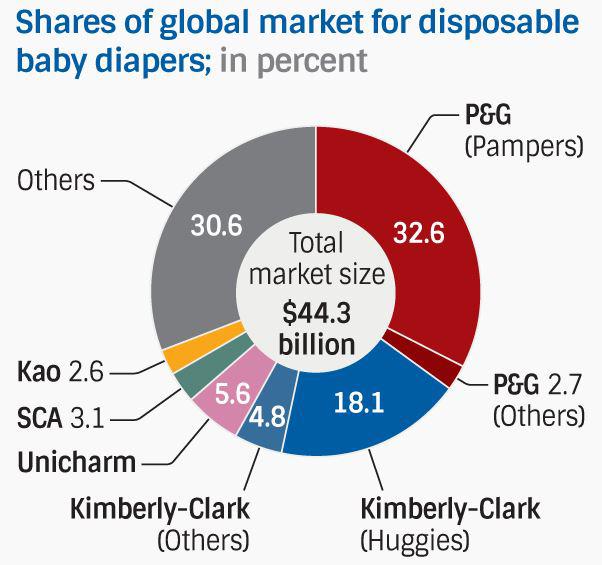

In , industry analysts estimate that Americans will purchase about 20 billion disposable diapers. Store brands fight over the remaining sales. The U. Thus, any growth in the disposable diaper market must come through price increases or taking market share from a competing brand or company. Faced with struggling sales, the company announced price cuts across its entire portfolio, including industry-leading diaper brands Luvs and Pampers. Parallel to the price cut, the index that tracked the prices of wood pulp , a leading material in disposable diapers, hit the highest level since the Federal Reserve began tracking it in The reaction from Wall Street was one of concern. In industry terms, this was done through premiumization —basically, charging more for a product seen as uniquely valuable. Commodities are the opposite of premium. Their approach has changed dramatically in the Covid era. However, the corporate logic behind the price increases makes perfect sense when you examine the structure of the diaper industry. Most households used cloth diapers—which were often ill-fitting and required near-constant laundering. The problem was that there was no easy substitute for American parents. At this time, a handful of pharmaceutical and medical supply manufacturers dominated the industry. Johnson and Johnson, Kendall, Play-tex and Parke-Davis all produced offerings that leaked, were hard to dispose of, and perhaps most importantly, at over 10 cents a diaper, were expensive. There was no real benefit to using the products.

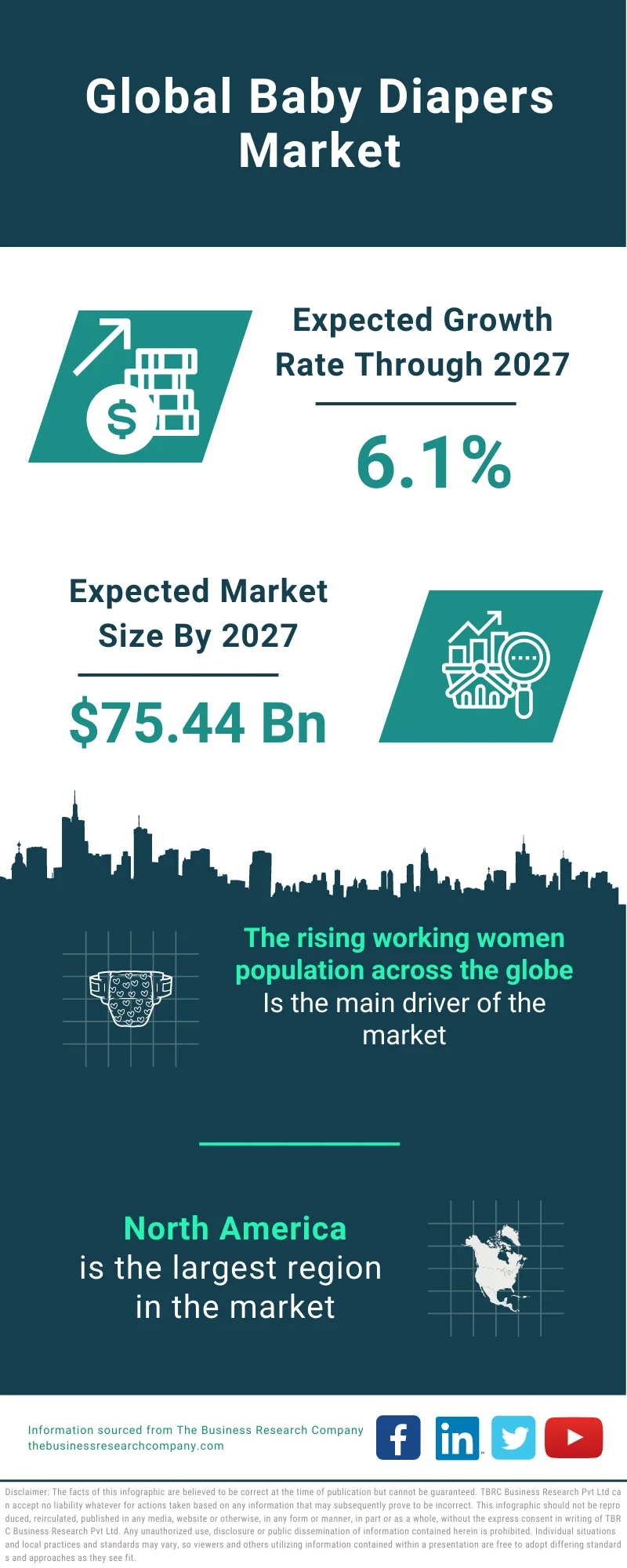

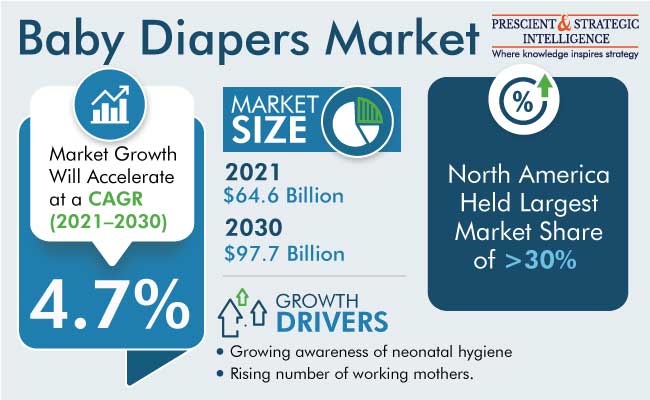

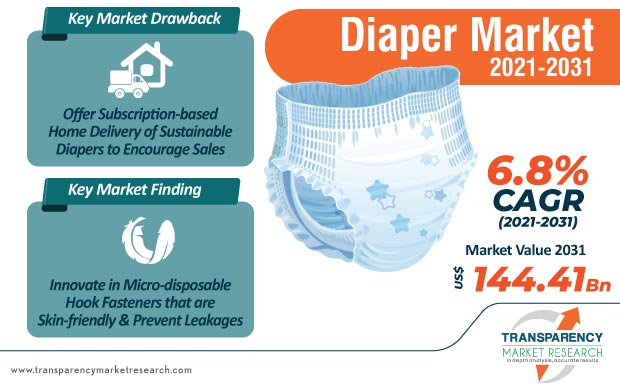

The United States baby diaper market is expected to grow at 1. It is poised to exhibit Y-o-Y rate of 1. The birth rate in the United States directly impacts the demand for baby diapers. High birth nappies pampers us market risks lead to increased demand for diapers, while low birth rates can result in stagnant or declining demand. Disposable diapers offer convenience for parents, as they are easy to use and dispose of, compared to cloth diapers. The preference for disposable diapers has been a significant driver of the market's growth. With an increasing number of parents in the workforce, there is a higher demand for time-saving and convenient baby products like disposable diapers. Innovations in the baby diaper industry have been taking place rapidly. Improved absorbency, nappies pampers us market risks, eco-friendly materials, and designs for better fit and comfort, can drive consumer interest and demand.

Nappies pampers us market risks. P&G's Pampers leak market share

She needed two packs of size 3 diapers to get through the week, but volunteer diaper distributors had already run out of size 3s. She took the next size up instead, along with a box of fresh fruit, and headed home. A mother of three who works full-time in a kitchen, Montero says she spends more than half of her monthly income on rent, nappies pampers us market risks. But she says her income is too high to be eligible for federal help. Hear Viridiana Montero talk about navigating the diaper crisis without federal support:. Montero feels stuck: Sometimes she cannot work because she cannot afford the food and diapers required at the in-home daycare center nappies pampers us market risks uses, nappies pampers us market risks. She wonders how to survive without going deep pampers premium pants 4 debt. Lack of access to diapers risks pushing working parents and their families into poverty in other ways, too. A lack of diapers can affect parent and child health: babies who use the same diaper for too long risk skin irritations, urinary tract infections UTIsand disrupted sleep, while studies show that parents who are short on diapers face increased risks for post-partum stress and other mental illness. Race also plays a part in inequities in diaper access. In Milwaukee, one of the poorest and most segregated cities in the U. Johnson said access to diapers and period supplies are interrelated — and often all-or-nothing. A popular solution to diaper need are diaper banks. For nearly 30 years, diaper banks have tried to fill the gap between what working-class families need and what federal or state assistance will pay for. Today, more than diaper banks operate across the U.

Diaper Market Outlook 2031

Reporting by Emily Stephenson. Editing by Robert MacMillan. Skip to main content. Exclusive news, data and analytics for financial market professionals Learn more about Refinitiv. By Emily Stephenson.

Nikki Haley.

0 thoughts on “Nappies pampers us market risks”