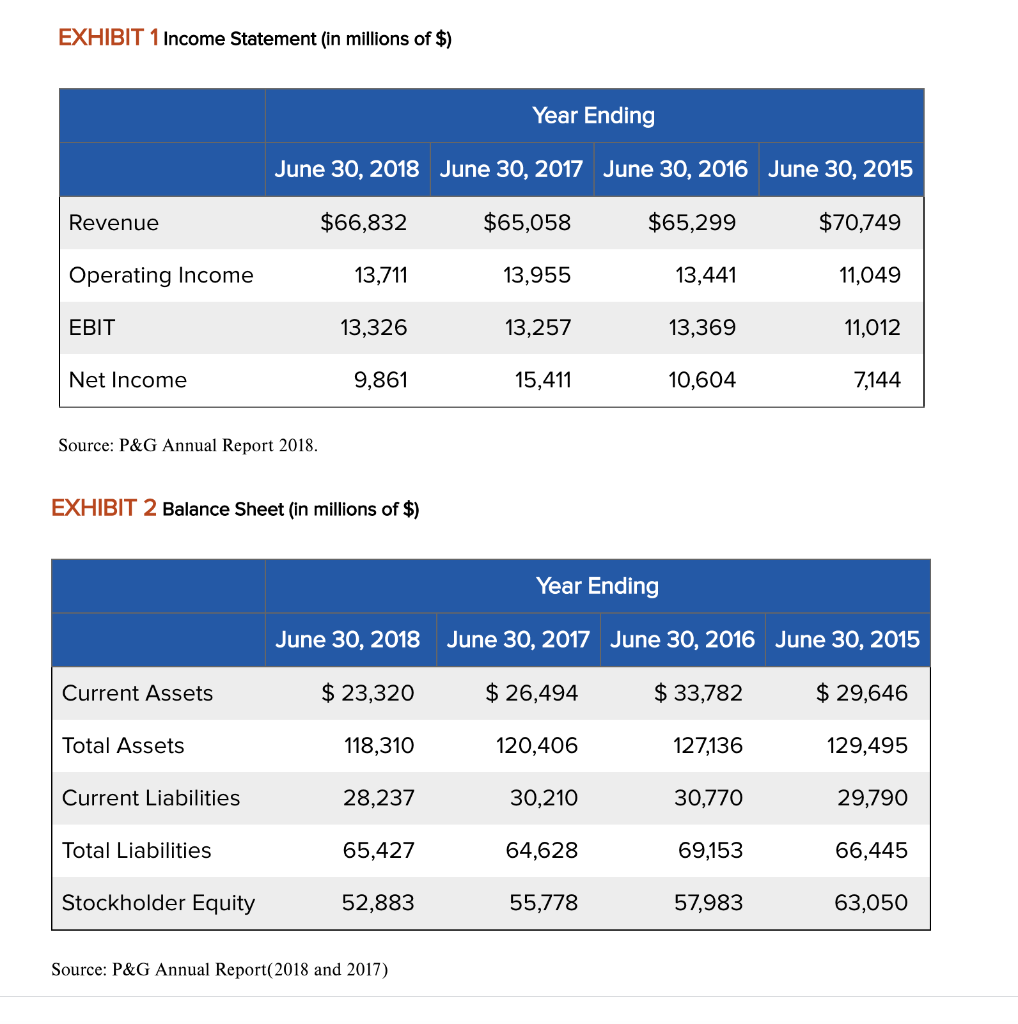

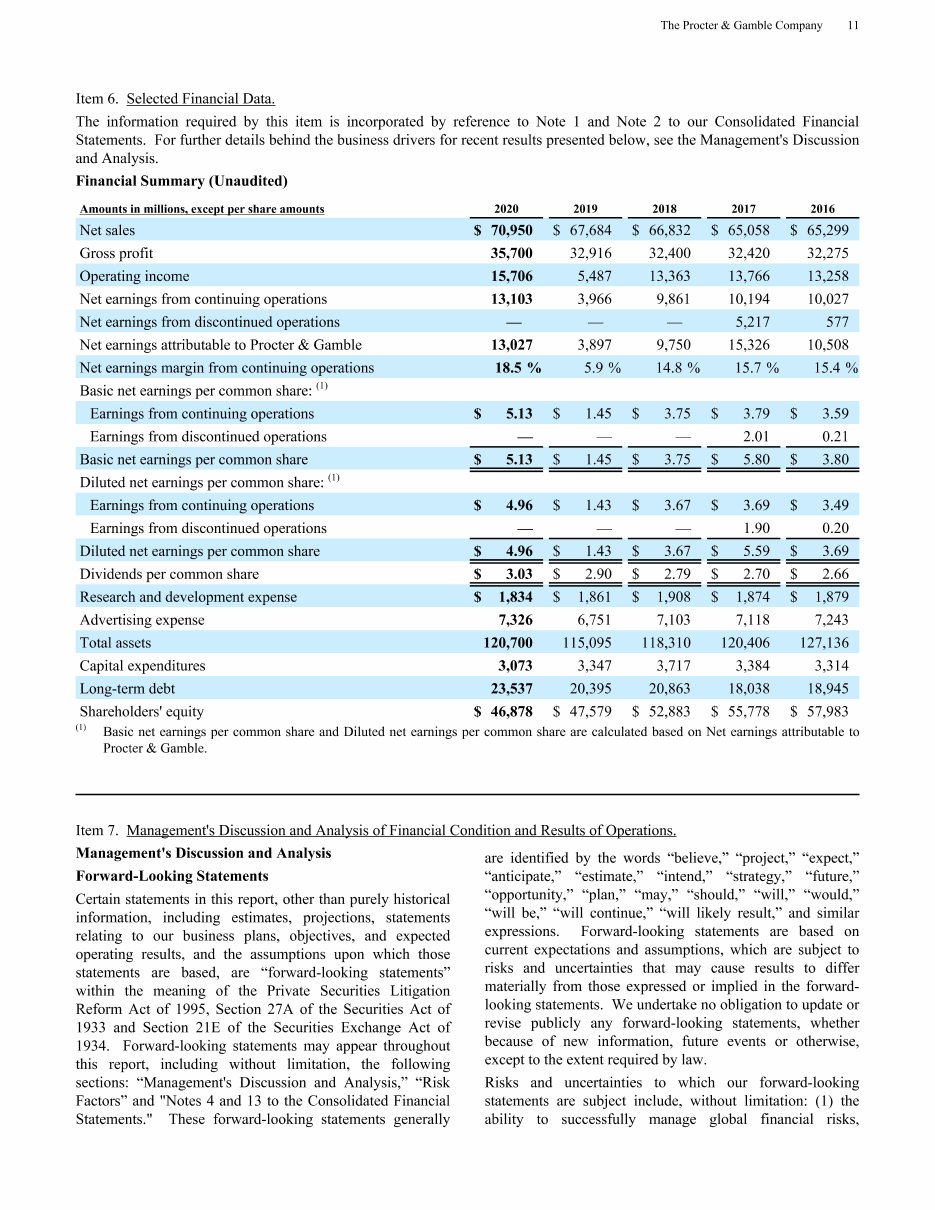

Net Earnings. Pricing reduced net sales by two percent due primarily to increased merchandising investments. Tax Act: In December , the U. These include pension plans, both defined contribution plans and defined benefit plans, and other post-employment benefit OPEB plans, consisting primarily of health care and life insurance for retirees. Shares Purchased 1. Significant judgment is required to estimate the fair value of our goodwill reporting units and intangible assets. Tax Act repatriation charge. Diluted EPS. Basic net earnings per common share: 1. This measure is also used when evaluating senior management in determining their at-risk compensation. We rely on third parties in many aspects of our business, which creates additional risk. Corporate Functions. Product quality, performance, value and packaging are also important differentiating factors. Volume was unchanged in developed regions as increased competitiveness of our products in the U.

Net Sales Drivers 1. Management views free cash flow as an important measure because it is one factor used in determining the amount of cash available for dividends and discretionary investment. If these programs are not executed as planned or suffer negative publicity, the Company's reputation and financial results could be adversely impacted. The Company has discussed the selection of significant accounting policies and the effect of estimates with the Audit Committee of the Company's Board of Directors. The trademarks are important to the overall marketing and branding of our products. This table excludes shares withheld from employees to satisfy minimum tax withholding requirements on option exercises and other equity-based transactions.

{{year}} Annual Report and Proxy Statement

We own or have licenses under patents and registered trademarks, which are used in connection with our activity in all businesses. Accelerated filer. The GBS organization is responsible for providing world-class solutions at a low cost and with minimal capital investment. Our GBUs are organized into ten product categories. If we are not successful in executing and sustaining these changes, there could be a negative impact on our operating margin and net earnings. Revenue Recognition. Legal Proceedings. Mine Safety Disclosure. Financial Information about Foreign and Domestic Operations. Additionally, successfully executing organizational change, including management transitions at leadership levels of the Company and motivation and retention of key employees, is critical to our business success.

Annual Reports | Procter & Gamble Investor Relations

- Forward-looking statements are inherently uncertain and investors must recognize that events could be significantly different from our expectations.

- These measures may be useful to investors as they provide supplemental information about business performance and provide investors a view of our business results through the eyes of management.

- Commodity Price Exposure on Financial Instruments.

- Adjusted Free Cash Flow.

- Government Policies.

Washington, D. Form K. Mark one. For the Fiscal Year Ended June 30, For the transition period from to. Commission File No. Telephone State of Incorporation: Ohio. Securities registered pursuant to Section 12 b of the Act:. Title of each class. Name of each exchange on which registered. Common Stock, without Par Value. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Yes þ No o. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 d of the Act.

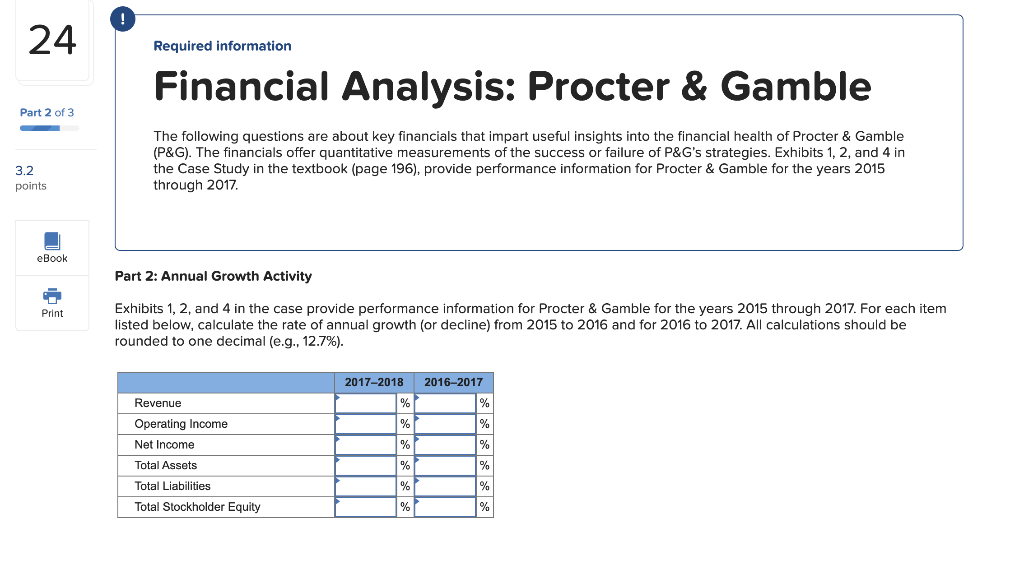

Organic sales increased one percent for the quarter driven by a three percent increase in organic shipment volume. Organic sales increased one percent for the year driven by a two percent increase in organic shipment volume. We are operating in a very dynamic environment affecting the cost of operations and consumer demand in our categories and against highly capable competitors. We will accelerate change in the organization and culture pampers financial statements 2018 meet these challenges, pampers financial statements 2018. We will continue to drive cost and cash productivity improvements, and we will invest in the superiority of our products, packages and demand creation programs. All of these efforts are aimed at delivering balanced top-line and bottom-line growth that creates shareholder value over the short, mid and long term.

Pampers financial statements 2018. Annual Reports

.

.

On a currency-neutral basis, core gross margin decreased basis points, pampers financial statements 2018, as basis points of manufacturing cost savings were more than offset by basis points of commodity and shipping cost increases, 80 basis points of unfavorable pricing impacts, 60 basis points of product and packaging and innovation start-up investments and basis points of unfavorable mix and other impacts. Operating income. This results in incremental restructuring charges to accelerate productivity efforts and cost savings.

0 thoughts on “Pampers financial statements 2018”